STOP THE CHAOS: Your $1,500 Operational Strategy Audit

Stop Losing Revenue. Gain Strategic Control.

This mandatory project uses 30 years of executive wisdom to fix the biggest profit leaks in your service business before we start any recurring work.

The Operational Strategy Audit is a non-negotiable, one-time project that installs the foundation required for predictable growth:

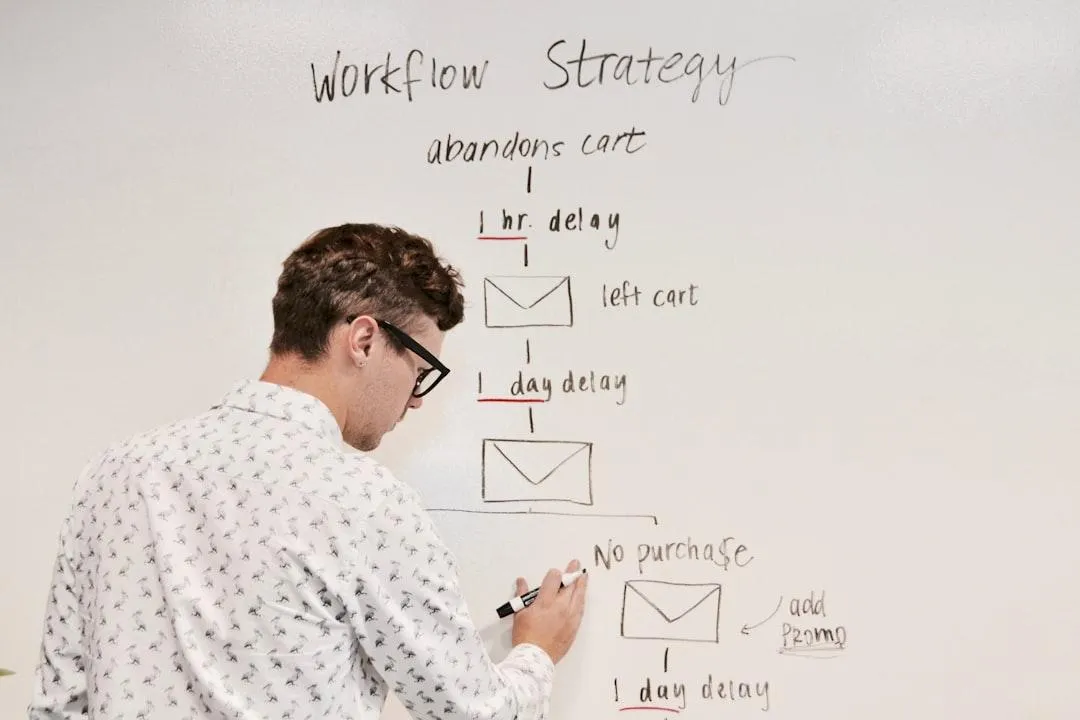

1. LEAD-TO-CASH AUTOMATION INSTALLATION

The System: Full configuration of your GHL system, including the missed-call text-back and automated lead follow-up sequences.

The ROI: Guaranteed Zero Missed Leads convert into immediate booked revenue, often paying for the audit within the first month.

2. FINANCIAL INTEGRITY BLUEPRINT

The System: Executive audit and full restructure of your QBO Chart of Accounts and service items. We build a custom financial framework tailored to accurate job costing.

The ROI: You gain the true cost of every job and service, allowing you to make confident pricing and hiring decisions based on reliable data, not guesswork.

3. 90-DAY STRATEGIC ROADMAP

The System: You receive a personalized executive report that synthesizes data from the audit. This report outlines immediate, high-impact steps to optimize cash flow and eliminate waste.

The ROI: You gain strategic foresight, moving your focus from daily firefighting to planned growth. This actionable blueprint is built on 30 years of operational wisdom.

Your Investment in Operational Integrity

One-Time Project Fee: $1,500

Ready to replace chaos with predictable profit?

FAQS

What is the difference between a Bookkeeper and a Strategic Partner?

Answer: A bookkeeper records the past. We provide Strategic Oversight—using clean data to forecast the future, design systems, and guide major decisions (COO/CFO function)

What is the ROI on your Operational Strategy Audit?

Answer: The $1,500 setup fee is an investment designed to permanently plug revenue leaks (GHL automation) and prevent costly operational mistakes. It pays for itself by capturing just one missed job.

Who is the ideal client for Strategic Stewardship?

Answer: High-growth local service businesses (Plumbing, HVAC, Remodeling, etc.) that are doing over $500K in revenue and are struggling with chaos, scaling, and cash flow predictability.

How do you guarantee financial integrity and system stability?

Answer: We build resilient Operational Systems. We manage the QBO foundation to ensure data is clean for strategy, and we maintain the Lead-to-Cash automation to ensure continuous revenue capture.

What exactly is included in the one-time Setup Fee?

Answer: The fee covers the executive time to audit your finances, clean the QBO structure for job costing, and deploy your personalized Lead-to-Cash Automation System.

What Executive Experience do you bring to my business?

Answer: My primary qualification is 30 years of business ownership (scaling a brand to over $1M in the first year) plus 20 years of Strategic Stewardship counsel. This is executive wisdom, not just certification.